The 8-Second Trick For Insurance Account

Wiki Article

Insurance Fundamentals Explained

Table of ContentsUnknown Facts About Insurance AdsThe Definitive Guide to InsuranceInsurance for BeginnersAll about Insurance10 Simple Techniques For Insurance Agent

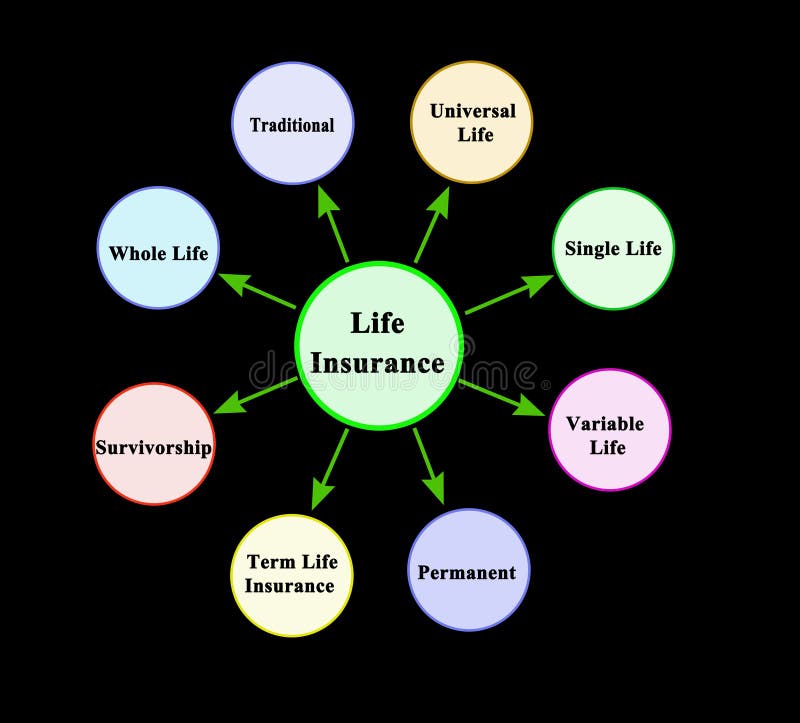

Other sorts of life insurance policyTeam life insurance policy is usually offered by employers as component of the firm's work environment benefits. Costs are based upon the team in its entirety, as opposed to each individual. As a whole, employers use basic insurance coverage for totally free, with the alternative to purchase extra life insurance if you need a lot more coverage.Mortgage life insurance covers the current equilibrium of your mortgage as well as pays to the loan provider, not your family members, if you pass away. Second-to-die: Pays after both insurance policy holders pass away. These plans can be made use of to cover inheritance tax or the care of a dependent after both insurance policy holders die. Often asked inquiries, What's the very best kind of life insurance coverage to get? The best life insurance policy policy for you comes down to your requirements as well as budget plan. Which sorts of life insurance policy deal flexible premiums? With term life

insurance and whole life insurance policy, costs usually are dealt with, which means you'll pay the same quantity on a monthly basis. The insurance policy you need at every age varies. Tim Macpherson/Getty Images You require to acquire insurance policy to secure yourself, your household, as well as your riches. Insurance coverage might save you hundreds of bucks in the occasion of a mishap, disease, or disaster. Medical insurance and also automobile insurance are called for, while life insurance policy, home owners, tenants, and disability insurance policy are urged. Begin completely free Insurance isn't one of the most exhilarating to consider, but it's essentialfor securing yourself, your family members, as well as your wealth. Mishaps, disease, as well as disasters occur all the time. At worst, events like these can dive you into deep economic wreck if you do not have insurance coverage to draw on. And also, as your life adjustments(state, you obtain a new task or have a child)so must your coverage.

More About Insurance Quotes

Listed below, we've discussed briefly which insurance protection you must strongly take into consideration purchasing at every phase of life. Once you exit the functioning world around age 65, which is usually the end of the longest policy you can acquire. The longer you wait to purchase a plan, the better the eventual expense.If someone else counts on your earnings for their monetary well-being, after that you possibly require life insurance policy. Even if you do not have dependents, there are various other reasons to have life insurance coverage: personal pupil funding financial debt, self-employment , or a family-owned business. That's less than the price of a fitness center subscription to shield your family members's financial stability in your absence. The most effective life insurance coverage policy for you depends upon your budget in addition to your financial goals. There are two main types of life insurance coverage policies to select from: permanent life as well as term life. When your dependents are no more depending on you for economic support. Insurance coverage you need in your 30s , Home owners insurance policy, Home owners insurance is not required by state law. However, if you have a mortgage, your lender will need homeowners insurance to protect the investment.Homeowners insurance policy secures the house, your items, and also uses obligation protection for injuries that happen on your home.If you sell your residence and also go back to renting out, or make various other living setups. Pet dog insurance coverage Animal insurance might not be thought about an essential, unless. insurance expense.

All About Insurance Code

you intend to shell out $8,000 for your animal's surgical treatment. Some strategies also cover regular veterinarian sees and also inoculations, and a lot of will certainly repay as much as 90%of your veterinarian expenses. This is where long-lasting care insurance coverage or a hybrid policy enters play. For individuals that are maturing or disabled and require aid with day-to-day living, whether in a nursing residence or with hospice, lasting care insurance can aid shoulder the inflated expenses. Long-term treatment is costly. Nevertheless, many Americans will require long-lasting care at some factor throughout their retirement. You are going to Spain for the very first time. insurance asia. You have a stop-over at Abu Dhabi. Your very first flight obtains delayed. You miss out on the second flight and obtain stuck. You are driving to work like every various other day. The roadway has oil spill.

Indicators on Insurance Asia Awards You Need To Know

Endowment Policy -Like a term policy, it is likewise legitimate for a particular duration. Money-back Plan- A specific percent of the amount assured will be paid to you periodically throughout the term as redirected here survival benefit. -Your insurance form household obtains the whole amount guaranteed in case of death during the policy periodDurationWhat is General Insurance coverage? A general insurance is a contract that supplies financial settlement on any type of loss apart from death. You could, thus, proceed and surprise your companion with a ruby ring without stressing over the therapy prices. The dent in your automobile didn't create a damage in your pocket. Your motor insurance' very own damage cover spent for your auto's damages triggered by the mishap.

The 5-Minute Rule for Insurance Meaning

In fact, the insurer worked out the bill directly at the garage. Your medical insurance looked after your treatment expenses. Your financial savings, thus, remained unaffected by your sudden health problem. As you can see, General Insurance can be the response to life's numerous troubles. For that, you need to choose the best insurances from the myriad ones available. What are the types of General Insurance readily available?/ What all can be guaranteed? You can get practically anything as well as whatever insured. Pre-existing conditions cover: Your medical insurance looks after the therapy of illness you may have prior to acquiring the medical insurance policy. Accident cover: Your health and wellness insurance coverage can pay for the clinical treatment of injuries caused due to accidents and also problems. Your medical insurance can additionally assist you save tax obligation.Two-wheeler Insurance, This is your bike's guardian angel. It's comparable to Automobile insurance coverage. You can not ride a bike or scooter in India without insurance coverage. As with automobile insurance, what the insurance firm will pay depends on the kind of insurance coverage and also what it covers. Third Party Insurance Coverage Comprehensive Vehicle Insurance Policy, Compensates for the damages triggered to another individual, their car or a third-party residential property.-Damages caused because of synthetic activities such as riots, strikes, and so on. Residence structure insurance coverage This secures the framework of your residence from any type of dangers and also problems. insurance during divorce The cover is additionally included the permanent fixtures within your home such as bathroom and kitchen installations. Public liability coverage The damage triggered to one more individual or their property inside the insured home can also be made up.

Report this wiki page